Brand New Construction Homes

Award Winning Luxury Homes In Palm Coast Florida

New Construction

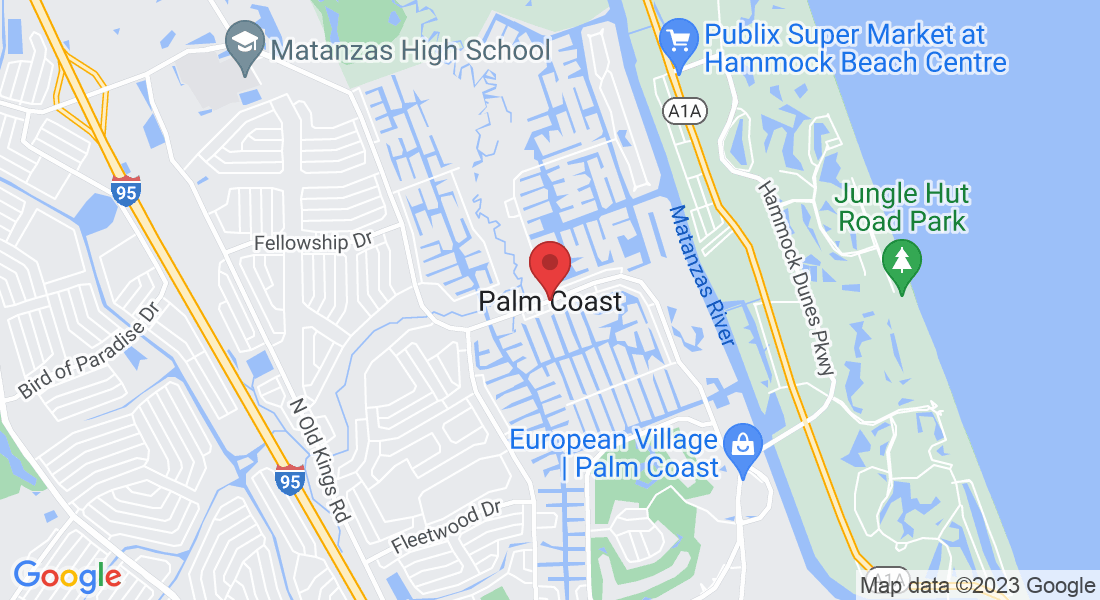

Palm Coast, FL

Introducing a brand new construction home, boasting modern design and top-of-the-line features. The gourmet kitchen is a chef's dream, with stainless steel appliances, granite countertops, and custom cabinetry. The open concept living area is perfect for entertaining, with plenty of natural light and easy access to the backyard oasis. The backyard features a sparkling pool, perfect for summertime fun and relaxation. Don't miss your chance to own this stunning new home, schedule a showing today!

New Construction Located In The Heart of Palm Coast

Builder Incentives

Don't miss out on this amazing opportunity to own a brand new construction home with $10,000 in incentives! This stunning home offers a gourmet kitchen, spacious living areas, a backyard oasis with a sparkling pool, and so much more. With this exclusive offer, you'll have $10,000 to put towards upgrades, closing costs, or any other expenses that come with buying a new home. This is a limited time offer, so take advantage of this incredible opportunity today. Imagine being able to personalize your new home with your own style and choices, you can use the incentive to add your own touch to the kitchen, bathrooms, flooring or even landscape, the possibilities are endless. Plus, with this incentive, you'll have a head start on building equity in your new home.

Great Location

This brand new construction home is located in an ideal location, offering the perfect balance of city convenience and suburban tranquility. The homes are just minutes away from a variety of shopping options, including a nearby mall and supermarkets.

The area is also home to several parks, perfect for enjoying the outdoors and getting some fresh air. Additionally, the location offers easy access to major transportation options, including the airport and train station, making it ideal for those who frequently travel.

The area also has easy access to the I-95 freeway, providing quick and easy access to all that the city has to offer. The location is perfect for those who want to be close to all the amenities of the city, while still enjoying the peace and quiet of a suburban neighborhood.

Excellent Schools

This brand new construction home is located in an area that is highly sought-after for its excellent schools. The homes are in close proximity to A-rated elementary, middle, and high schools, making it the perfect location for families with children. The schools in the area are known for their strong academic programs, dedicated teachers and staff, and a variety of extracurricular activities.

The elementary school is known for its emphasis on STEM education and its well-rounded curriculum that includes art and music. The middle school is known for its strong athletics program and its focus on preparing students for high school. The high school is known for its diverse range of courses, including Advanced Placement and International Baccalaureate programs, as well as its strong arts and sports programs.

This location is an ideal place for families with children to call home and make sure that their education is in good hands.

Spacious Living Area

The open concept living area in this brand new construction home is perfect for entertaining and family living. The large windows allow for plenty of natural light to flood in, creating a bright and inviting space. The living area is connected to the kitchen, making it easy to entertain guests while preparing meals. The floors in this area are hardwood, adding a touch of elegance to the space. The fireplace in the living area is a great focal point and perfect for cozy nights.

The home also features 4 bedrooms and 3 bathrooms, providing ample space for a growing family or guests. The bedrooms are all spacious and feature large windows and ample closet space. The master bedroom is a true retreat, with a large en suite bathroom and walk-in closet. The master bathroom features a spa-like shower and soaking tub.

Overall, this brand new construction home offers a perfect balance of elegant living spaces, comfortable bedrooms and modern bathrooms, and practical garage space, making it the ideal home for any family.

Luxurious Gourmet Kitchen

The gourmet kitchen in this brand new construction home is truly a chef's dream. It features stainless steel appliances, including a gas range and double oven, perfect for cooking and entertaining. The granite countertops provide ample space for meal prep and the custom cabinetry offers plenty of storage for all your kitchen essentials. The kitchen also includes a large island with a breakfast bar, providing additional seating and a great space for casual dining. The kitchen also features a walk-in pantry and a wine cooler, perfect for storing your favorite bottles. The large windows in the kitchen provide plenty of natural light and beautiful views of the backyard. Overall, this kitchen is not only beautiful but also functional and equipped with all the necessary amenities for a gourmet chef.

Amazing Outdoor Space

The backyard of this brand new construction home features a sparkling pool, perfect for summertime fun and relaxation. The pool is designed for entertaining, with ample space for lounging and a large area for swimming. The pool deck is made of a durable and slip-resistant material, making it safe for children and adults alike. The pool is also equipped with a built-in spa, perfect for relaxing after a long day or for enjoying a soak with friends and family. The pool area is surrounded by lush landscaping, providing privacy and a beautiful view.

The backyard also includes a covered patio, perfect for outdoor dining and entertaining. The patio is equipped with a built-in grill, making it easy to cook and dine al fresco. The backyard's overall design is a perfect place to entertain guests and spend time with family and friends. It's also a great spot to relax, unwind and enjoy the Florida's beautiful weather.The home also has a 2-car garage, providing secure and covered parking for your vehicles and extra storage space.